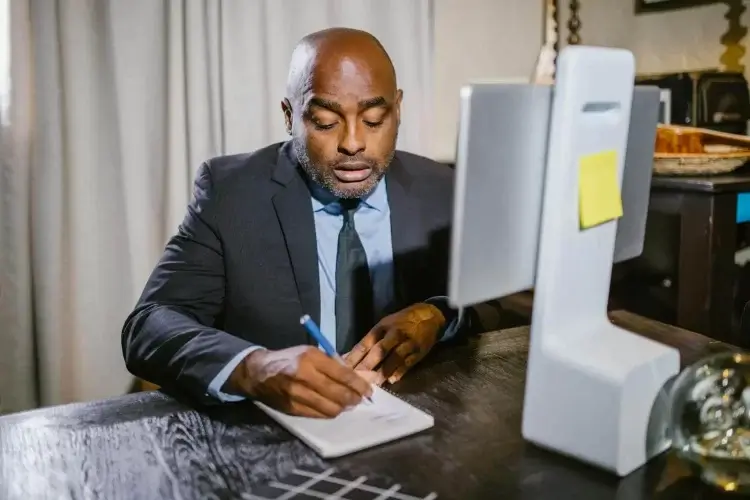

Why Retirees Rejoin Government Service

Each year, a significant number of retired federal employees return to government work, motivated by financial needs, intellectual engagement, or a commitment to public service. Some seek additional income and benefits, while others value the opportunity to apply their expertise in a structured and meaningful work environment.

Government agencies recognize the value retirees bring, offering various reemployment programs to retain institutional knowledge and ensure operational continuity. However, before making this decision, it is essential to understand how reemployment affects retirement benefits, tax obligations, and work-life balance.

Understanding the Impact on Federal Retirement Benefits

One of the most critical considerations is how returning to government employment affects your federal retirement benefits. In some cases, re-employed annuitants experience a reduction in pension payments, as their salary offsets retirement income. To avoid unexpected financial changes, it is crucial to analyze the specific terms set by the Office of Personnel Management (OPM) and the employing agency.

Certain agencies offer waivers, allowing retirees to maintain their full annuity while earning a salary. Reviewing these policies in advance can help you determine whether reemployment aligns with your long-term financial stability. Additionally, understanding tax implications is key, as income from government work may place retirees in a higher tax bracket, influencing overall net earnings.

Here are essential factors to consider when evaluating the financial impact of reemployment:

- Pension Adjustments: Determine whether your annuity will be reduced due to your new salary.

- Tax Bracket Changes: Assess how additional earnings affect your taxable income.

- Agency-Specific Waivers: Explore whether your agency offers exemptions for full annuity retention.

- Benefit Contributions: Understand how returning to work influences health insurance and retirement savings plans.

- Financial Planning: Ensure that reemployment aligns with long-term retirement goals and expenses.

Careful financial evaluation allows retirees to make informed decisions, ensuring that returning to work enhances rather than disrupts their financial security.

Employment Terms and Work Arrangements

Retirees considering government work can choose from various employment structures, including part-time, temporary, and full-time roles. These options provide flexibility in managing workload while allowing retirees to contribute valuable expertise. Special hiring programs exist for seasoned professionals in critical positions, making it easier to transition back into the workforce without long-term commitments.

Reviewing contractual terms is crucial to align work responsibilities with personal and professional priorities. Understanding specific agreements ensures clarity on salary, work expectations, and potential benefits adjustments. Many agencies also offer remote work options, further enhancing flexibility for retirees balancing employment with personal pursuits.

Optimizing Productivity with Time Management Tools

Balancing work commitments post-retirement requires strategic time management. Whether working on a part-time schedule or a flexible contract, leveraging digital tools can help retirees stay efficient without feeling overwhelmed. Many government agencies integrate workforce management solutions to enhance accountability and performance.

Implementing effective time tracking strategies can significantly improve productivity and work-life balance:

- Using a Time Tracker: Automate work hour logging to maintain accuracy in reporting.

- Setting Task Priorities: Structure daily activities based on urgency and importance.

- Scheduling Breaks: Incorporate planned breaks to sustain energy and prevent burnout.

- Analyzing Work Patterns: Utilize productivity insights to adjust workflows and optimize efficiency.

- Ensuring Compliance: Align work hours with government employment policies for seamless integration.

By adopting structured time management practices, retirees can ensure a smooth transition back into government roles while maintaining control over their schedules.

Making an Informed Decision About Government Reemployment

Returning to government service post-retirement can be a fulfilling and financially beneficial choice when approached strategically. Evaluating the impact on retirement benefits, selecting the right employment structure, and utilizing digital tools for efficiency all contribute to a successful transition.

For those seeking better time management solutions, a time tracker online can enhance productivity and streamline professional commitments. Sign up today for a free trial and take control of your work schedule with ease.